It can’t be overstated how much of a hit in revenue publishers took in 2020. In its “Outlook for Data-Driven Marketing and Advertising in 2021” report, Winterberry Group estimates the decline in global ad spend at ~$39b compared to 2019.

Authored by Bruce Biegel, senior managing partner at Winterberry Group, the report bluntly stares down the themes that shaped the industry in 2020 — Identity, Tech, Performance and Scale — while looking at how these trends will define the landscape over the next year. It also unpacks how organizations are managing their data to brace for regulatory impact by executing a first-party data strategy, exploring permission-based collaboration solutions with third-party data providers, and shaping a new definition of what “2nd-party data” actually means.

In addition, Biegel co-authored a second report, “Collaborative Data Solutions: The Evolution of Identity in a Privacy-First, Post-Cookie World,” which drills even deeper into what mindful, consent-first data collaboration actually looks like.

I caught up with Biegel to learn more about Winterberry’s take on the state of Digital Media and Advertising in 2021 based on both reports, with a focus on the collaborative challenges that publishers must face amid crumbling cookies, new regulations and emerging ID solutions.

Justin Joffe: In WinterBerry’s “Outlook for Data-Driven Marketing and Advertising in 2021” report, you forecast that, in the post-cookie landscape more brands, media owners and tech solution providers will provide permission-based collaboration solutions by partnering with each other either directly, or through trusted third parties. Can you share some examples you’re starting to see of what effective, accountable third-party partnership looks like in Europe or elsewhere?

Bruce Biegel: From our interviews and from a discussion I did for I-COM, LiveRamp and Carrefour in France are successfully enabling partnered audiences through the Safe Haven in the U.K. publisher sector, [and] we spoke to several media owners in the video sector that are leveraging Infosum to encrypt audiences. In the U.S., all of the co-ops have been serving as trusted third parties for the hosting and analytics on transaction data including Alliant, Path2Reponse, Wiland, Abacus/Epsilon and Datalogix/ODC.

JJ: Can publishers really trust third-party providers are working on permission-based privacy solutions that won’t affect their CPCs and other metrics?

BB: I think that third-party providers are aligned with publishers in achieving privacy-based solutions that allow accuracy and scale with a hope of improving on the cookie ecosystem. The balance [between] scale of audience and greater accuracy will allow brands and agencies to better predict engagement metrics – and balancing their objectives with format will ultimately lead to better managed CPMs.

If they don’t achieve these solutions, and there is a reversion to less precision in audience targeting and inability to measure, I think we see downward pressure on metrics [where] reach will have to substitute for precision as it did in paid media pre-digital.

JJ: What organizational adaptation have third-party data partners taken when it comes to proposing solutions for the death of cookies like new ID system alternatives to compete with what Google is proposing?

BB: There is clear focus on permission at scale and validating provenance as a first step. The second step has been combinations of encryption and anonymization/ pseudonymization to protect the privacy of the audiences.

Making all of this measurable on the backend is also critical. The market understands that Google’s solutions work well in a scaled Google environment, according to Google. That is unlikely to be the same case for use outside of the walled gardens.

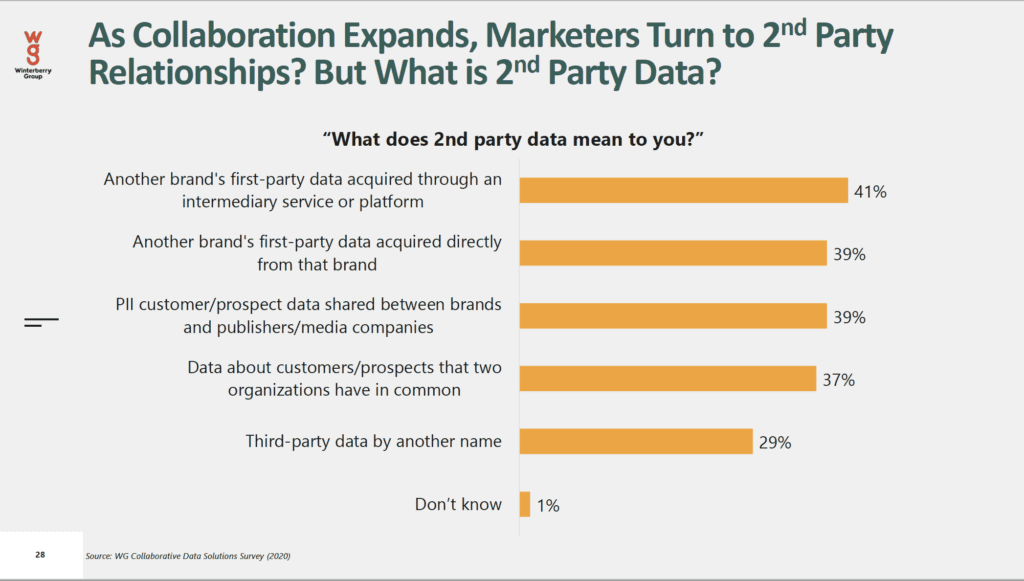

JJ: Your evolving definition 2nd party data is interesting: “Data that is shared in a dedicated environment with a clearly defined set of permissions and rights set between each of the parties, frequently with a third-party provider managing the environment.” In that relationship, between say a publisher and an SSP, what do you envision the SSP doing to better ‘manage the environment’?

BB: I think that there is potential for the SSP to provide an environment for audience analysis between publishers, and also between brands and publishers. The question is, what approaches they will use to go in this direction? Though I do see this as a complementary option to the buy side and to the longer tail of publishers.

JJ: Can you give us an example of what a “clean room” for collaborative data looks like in practice?

BB: Think about Safe Haven from LiveRamp, InfoSum Bunkers, Snowflake Data Exchange, Karlsgate – all of these are technology-based solutions with permissions added. The exact how each vendor works is best left for them [to speak on].

JJ: Marketing fragmentation finds retail media capturing retail ad dollars – likely contributing to that COVID-instigated ~$39b decline in ad/marketing spend as compared to 2019. Advertisers want more return on their performance marketing efforts, and your research found that they will focus their spend where products and buyers are together.

Are any of the new products that publishers have started rolling out in 2020 (like newsletters, subscriptions) able to fill some of that ROI void? If not, what else might help publishers play catch-up?

The challenge for publishers is to create content aligned with educating, informing and, where aligned, directly shoppable online.

BB: I don’t think that the retail media contributed to a decline – I see what they are doing as share shift from media companies and also from trade promotion /shopper marketing budgets – and in other cases completely new budget online to follow the consumer where they are – and they are on Amazon, Walmart, Target, CVS, etc.

The challenge for publishers is to create content aligned with educating, informing and, where aligned, directly shoppable online. It’s not all retail/CPG, think about travel content, hospitality sites and aggregators.

JJ: As distinguished from a data-co-op, data marketplaces/exchanges seem more risky amid looming privacy regulations, even though they are permission-based. As regulations require those permissions to be spelled out, what advantages do they present from a privacy/transparency perspective that something like co-ops or technical data environments don’t?

BB: I think that the long history of data management with detailed permission around use and use cases makes co-ops less of a focus for compliance risk. They have always had the questions on provenance and privacy so that it is not new to them. I think that the data exchanges, depending, are more focused now on the provenance of the data in an exchange, even if their model does not allow them to view that data.

CCPA in the US was a big push in the right direction, but it is also a focus down the value chain from the buy side through to the publishers, as no one wants to be on the wrong side of consent.

This conversation has been edited for length and clarity.