As the streaming era leaves its infancy, platforms must determine if they will adopt an ad-supported or an ad-free model for their content.

The streaming era of television has drastically changed how consumers watch content and, therefore, how advertising works. There are many streaming channels now — the doors that Netflix opened — and plenty of consumers have subscriptions to several platforms. But how are they able to afford them all?

For the past fifty years, the video industry used a dual revenue-stream model. This meant that TV networks and pay-TV operators shared the revenue consumers paid for subscriptions and the revenue generated from ads. Then the rise of Netflix’s ad-free platform birthed the streaming dynasty, opening a gamut of questions about the future of advertising in television.

Meanwhile, Hulu and other streaming services began offering ad-supported options at a lower price, which also led to the rise of the FASTS, and the popularity of the option showed that it was viable. It begged the question of which ad-supported tier would become the industry standard.

One of the original appeals of streaming was ad-free content, but as the streaming medium became oversaturated, ad-supported tiers became a tactical revenue stream. As the streaming wars waged on for three years, lower-cost ad-supported plans “have provided consumers with the ability to afford more services with their entertainment wallet.”

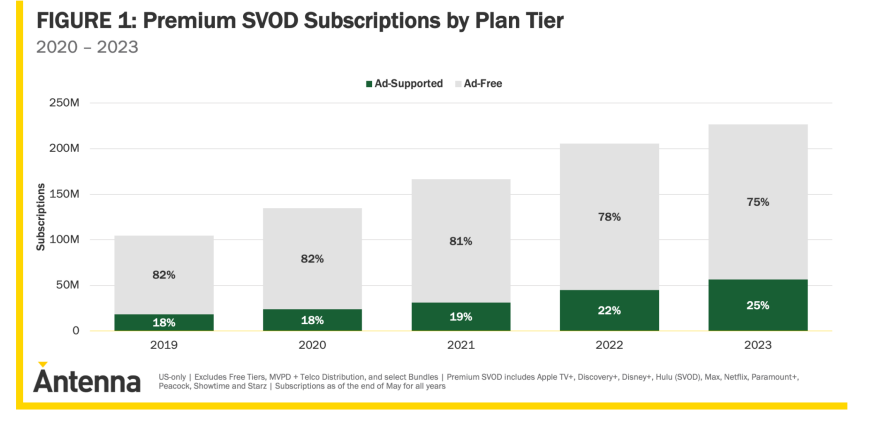

The growth of ad-supported plans has grown exponentially over five years. By the end of Q1 of 2023, ad-supported streaming made up one-fourth of SVOD subscriptions.

The Big Four: “Ad Avoiders,” “Ad Takers,” “Ad Managers,” and “Ad Oblivious.”

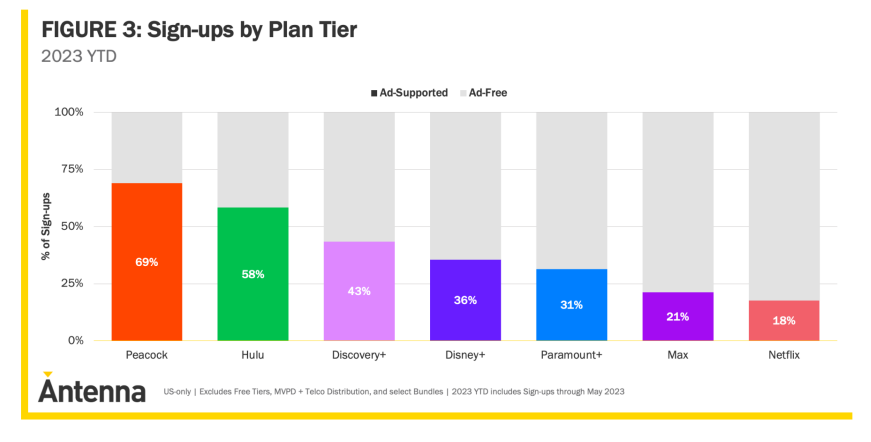

The popularity of ad-supported subscriptions is undeniable, but the statistics vary based on the streaming platform. For example, two out of three subscribers that signed up for Peacock in Q1 of 2023 chose the ad-supported plan. On the other hand, only one-fifth of subscribers signed up for the ad-supported tier on HBO Max and Netflix.

But why are consumers making these choices?

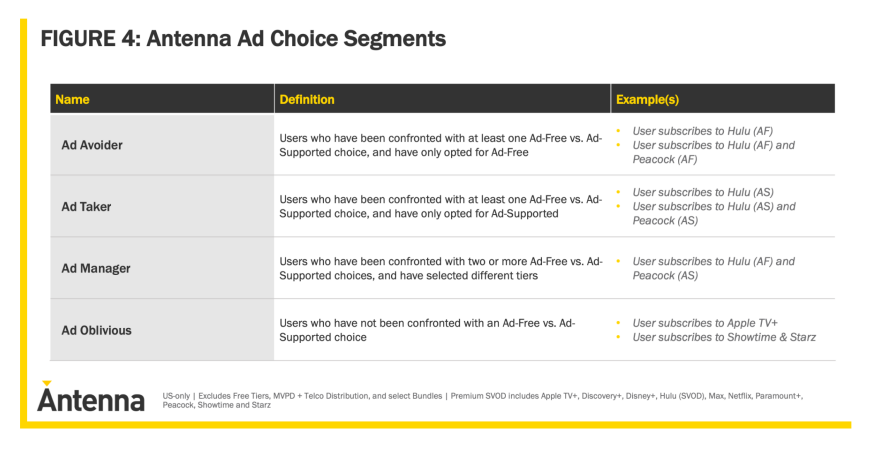

Antenna, the subscriber measurement company, created four consumer categories to understand consumer choice: Ad Avoiders, Ad Takers, Ad Managers, and Ad Oblivious.

Ad Avoider: This segment of subscribers always chooses an ad-free plan. Platforms presented them with an ad-free and ad-supported tier, and they always chose the former.

Ad Taker: This segment was presented with both options and chose the ad-supported tier.

Ad Manager: They mix and match both ad-free and ad-supported tiers.

Ad Oblivious: They have not yet signed up for a service where advertising was an option.

Ad Choice Segmentations (All Subscribers)

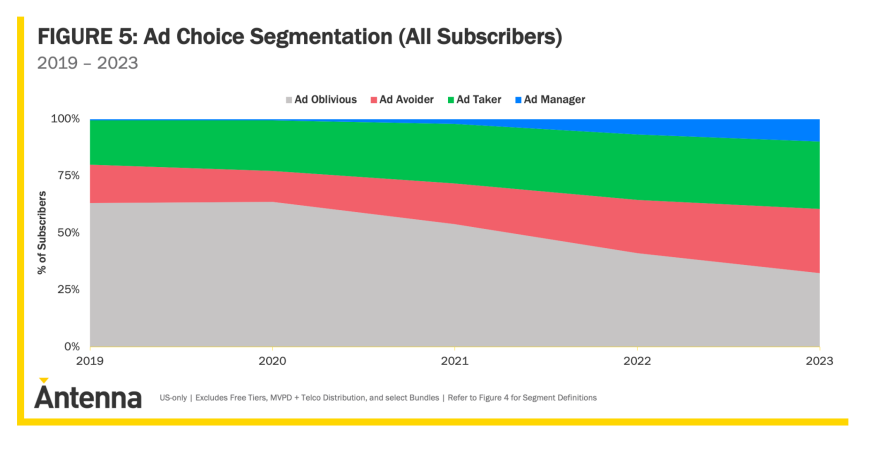

This idea of ad choice in CTV is a fairly new concept. Three years ago, 64% of U.S. video streaming subscribers were Ad Oblivious because platforms never presented them with a streaming service with an ad-supported subscription tier. Now the number is down to 32%, a significant drop.

The upcoming years will be vital for determining the future role of advertising in subscription-supported streaming. This is the first time the CTV industry is offering this amount of ad-supported streaming content, and platforms will need to take this time to understand if consumers bought into the value proposition of advertising, especially as one-third of subscribers remain Ad Oblivious.

If you put aside the Ad Oblivious segment and focus on the two-thirds of subscribers who made a choice, 58% of Americans chose advertising either some or all the time they had the option. However, Ad Avoiders are the largest single segment at 42%.

The Ad Manager portion, in which subscribers filter back and forth between both options, might be the way of the future. The Ad Manager portion is small, but there is room for exponential growth.

“By definition, a consumer can’t be considered an Ad Manager until one has made the ad choice at least two times. If we isolate only the consumers who have been faced with the ad choice two or more times, a fascinating story emerges: 71% of these Americans have chosen advertising at least once. And nearly one-in-two are Ad Managers. Consumers are not only learning to choose whether or not they want ads, but they are also learning to decide on a service-by-service basis,” wrote Antenna.

There’s room for both ad-free and ad-supported services in the future. The data shows that it depends on the platform.