I don’t always pay attention to Google/Alphabet earnings announcements—all that frowning and brow-furrowing is adding wrinkles, and my coworkers complain about the constant sighing—but Big G dumped a bunch of interesting stuff into the fourth quarter and fiscal year results.

And of course, more intriguing than the numbers is pondering, “Why?” After all, Google moves in mysterious ways, and trying to decipher its cryptic machinations can be a fun and potentially profitable pastime.

First, YouTube ad revenue was finally revealed! Over 2019, Google brought in $15 billion that no other SSPs can have a hand in monetizing. We also learned that was damn impressive growth from 2017’s $8.2 billion and 2018’s $11.2 billion.

Seems that “brand safety” concerns will never dent the YouTube revenue funnel. We’ve talked many a time about how YouTube is the easiest point of entry to digital video advertising for smaller advertisers with lower budgets. So expect that number to skyrocket even further because it’s an election year and campaigns of all types will be plunking down donor dollars to get their vids in front of voter eyes.

Where’s the TAC?

However, when Google opens one door, it apparently closes another. Not included in this report were traffic acquisition costs (TAC) from Google Ad Manager, AdMob, and Ad Sense. Publishers might better recognize that as Google’s take rate, famously 30% but now… unknown.

Google quietly removed the TAC for Google Ad Manager/AdMob/AdSense when it added YouTube breakdown.

Days of knowing $GOOG took a 30% cut before passing 70% to publisher are over. Anyone care or no big deal? pic.twitter.com/k0gMPzv6gA

— Sarah Sluis (@SarahSluis) February 4, 2020

So why skip out on including the take rate? Well, the speculation on Ad Tech Twitter circled around Google significantly lowering its take rate to entice publishers.

I’ve been arguing that Google is trying to squeeze its grasp around publishers via GAM and the Unified Auction as its clear publishers are empowered by the collapse of the third-party cookie. Arguably, the stick hasn’t worked as many publishers tell us they’re seeing bumps in revenue from Prebid and other header sources post-Unified Auction.

So how about a carrot? A discounted take rate that none of your other demand sources can match—suddenly Google is a hot, hot yield channel.

Other speculation runs around Google depositing AdX into Open Bidding, truly leveling the Unified Auction and potentially relieving some of the gaining antitrust furor, which is apparently focused on Google’s advertising business according to a timely Wall Street Journal report.

Beeswax CEO and ad tech sage Ari Paparo goes even further and ponders whether Google is preparing investors for the eventual sacrifice of AdX.

The tinfoil hats among us think Google broke out revenue so Wall St won’t panic when they kill AdX or make concessions to the antitrust efforts. “Network is slowest growing sector compared to YT, so this is a net positive, etc.”

— Ari Paparo (@aripap) February 4, 2020

JEEVES, PREPARE MY FAINTING CHAIR!

Google squashing AdX is not that crazy of a suggestion because 1) it will shove off some of the aforementioned antitrust pressure; 2) It’s not Google’s best performing business (even under siege on mobile from Amazon, search remains the golden cash calf 3) Google will still have access to Open Bidding via its DSP—in fact, dropping AdX into Open Bidding is effectively the same thing.

Operation: TURTLEDOVE

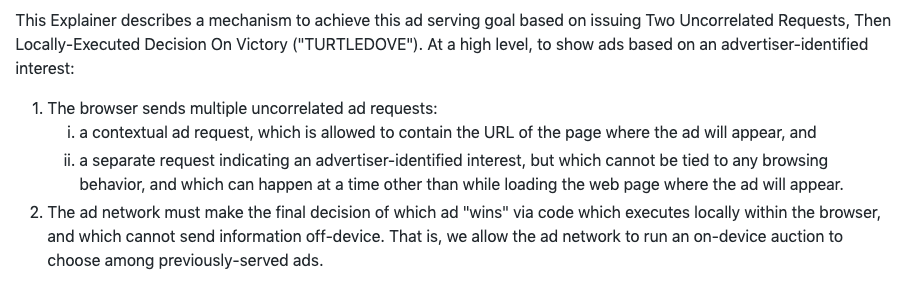

Which brings us to something CafeMedia’s Paul Bannister noticed in Google’s dump of tech proposals alongside the sunsetting of third-party tracking cookies and formal introduction of the Privacy Sandbox. Enter TURTLEDOVE, which yes, is actually an acronym for “Two Uncorrelated Requests, Then Locally-Executed Decision On Victory”

Basically, it’s a proposal to bring the auction and final decisioning out of the cloud… and into the browser. Yes, Google—that company that lamented the terrible things the header was doing to latency while proclaiming the brilliance of server connections—potentially wants to jump in the header and leverage edge computing.

Why, why, why? You ask. The GitHub suggests privacy is front of mind, but as Bannister notes there may be plenty of revenue benefits as well… for publishers.

Just like PreBid, having the auction in the header would increase transparency into auction machinations and bids—ones that are currently invisible within Google’s server setup. That would give publishers much more valuable data for yield management (while also swiping away some anti-competition claims).

If Google was to then kill AdX or place it within open bidding, all the more transparency. But combine that with lowered take rates/fees? Well, Bannister suggests this could be a PreBid killer…

5/ If Google made their own “wrapper” (GATE – GAM at the Edge) that took OB functionality, had an AdX “adapter” and pulled direct deals trafficking info from a cloud-based server, it could have a Prebid-killer on its hands.

— Paul Bannister (@pbannist) February 4, 2020

I don’t know if I would go that far and suggest we’ve discovered Google’s completely public plan for display ad tech domination. For one thing, the “Two Uncorrelated Requests” section of TURTLEDOVE splits up contextual (URL) and “advertiser-identified interest” signals, which would seemingly be problematic for advanced ad targeting. But certainly such maneuvering would cause a lot of pain for already struggling demand sources.

And on the whole, pushing the Unified Auction out from the cloud into the browser would massively change browser-based monetization. It would affect publishers across departments beyond revenue—development and user experience come immediately to mind.

But it’s not that crazy of an idea as network connections get stronger (cough, cough, 5G anyone?) and tech providers reap the benefits of the edge. And there is real argument to be made that browser-based auctions and decisioning would improve transparency and ameliorate privacy concerns.

Changing the Rules

Even if the tea leaves point to Google luring publishers further into its realm with take-rate carrots, the company isn’t putting away the stick anytime soon.

As I was writing this up, News Corp’s Stephanie Layser noted a recent update for Google Ad Manager will limit—or potentially completely cut off—publisher ability to prioritize header bidding line items.

New policy change from Google…we have until May to make sure we aren’t prioritizing HB line items. In case you like to run your PMPs in anything outside of G. If that ain’t anticompetitive, I don’t know what is. https://t.co/Rsh5eKq6GY

— Stephanie Layser (@slayser8) February 5, 2020

Anyway, I know I’m somehow going to have a lot MORE to talk about with Jounce Media’s Chris Kane during Digital Media Drilldown at Publisher Forum Santa Monica, Mar. 8-11. And I thought I had enough with the duplicate auctions conversation alone! Of course attendees can also pester the Google folk about who will be at the conference flying their GAM colors.