Like a leaky faucet drip-drip-dripping into a steel sink, mobile has long been that nagging concern keeping publishers up at night. The amount of inventory seems to multiply daily with little demand from buyers (especially when it comes buying guaranteed), so publishers are forced to turn to ad networks and programmatic channels for the pennies they can get. No surprise then that questionable and low-quality creative is popping up all over mobile sites and apps.

Many pubs are taking hints from Facebook and Twitter’s mobile revenue successes by employing feed delivery systems to push advertising into the content stream, and then leaning on native/content-marketing products as well as custom-built solutions that leverage HTML5 for eye-catching features. However, it’s difficult to scale custom products that tend to be cost- and labor-intensive.

Then there’s mobile video.

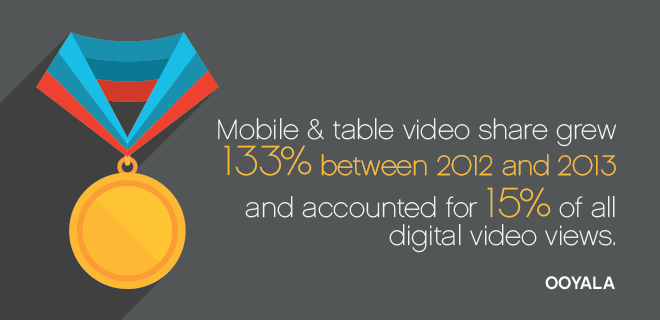

Well, yes, video CPMs are sweet, but are consumers really watching choppy video content that sucks up their data plans? Sure, Ooyala reported last year (PDF) that mobile and tablet video share had grown 133% worldwide between 2012 and 2013, but the total share of videos viewed on these devices is only 15%. Plus, digital video supply is barely keeping up with advertiser demand – could there be enough to make it a worthwhile mobile channel? Don’t forget that video ad delivery is quite different from display, which is no comfort when mobile display ad serving functions somewhat smoothly only after years of trial by fire.

These are typical concerns publishers regarding mobile video advertising, but serving technology has come a long way – particularly in minimizing issues like latency and data usage, which threaten user experience.

Of course, there are also the digital publishers who say, “We don’t have any digital video inventory – no desktop, no mobile.” Except mobile video is not limited to being served around video content. Increasingly, providers are enabling publishers to serve mobile interstitials that feature video, allowing any and every publisher with a mobile presence to cash in on a growing revenue channel. And limited video supply is no longer an issue when video ads can be served on seemingly infinite mobile display inventory.

Beyond offering the potential to be the long-awaited mobile revenue champion, there’s a high possibility that mobile video could ultimately be a more lucrative channel than desktop video due to its high level of engagement. However, the space must overcome serious challenges regarding fragmentation among buy sources and the lack of a panel-based metric that can be used across channels.

Saving User Experience

A giant swath of that mobile inventory stockpile belongs to games. However, according to eMarketer, advertising will only account for $373 million of the $2.24 billion in revenue mobile gaming will garner in 2014. This isn’t surprising considering the low cost of mobile display. More lucrative monetization options include virtual goods, which are predicted to bring in $960 million in 2014, and downloads, $907 million.

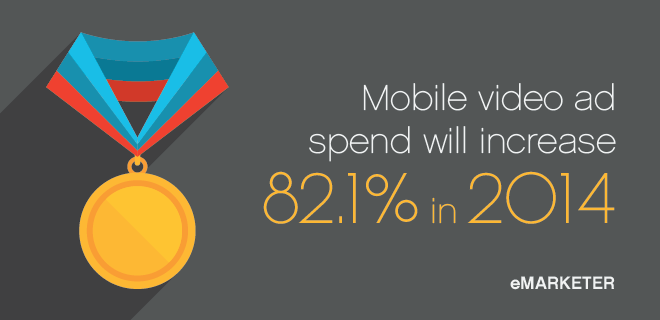

As eMarketer estimates mobile video ad spend will grow 81.2 percent this year, some mobile game developers appear to see the opportunity. Angry Birds creator Rovio recently announced in second-quarter 2014 it was rolling out video products that will be built into the gameplay of a number of its titles.

Beyond the potential revenue, mobile video units tend to garner high engagement rates because users are less prone to distraction – it’s not like desktop where a user can switch browser tabs or television where the viewer can speed off to the bathroom/kitchen. To some extent, mobile video ad viewers are a captive audience, locked in their current app (including browsers) – which makes it all the more important that viewing video ads is not detrimental to user experience.

Mobile gaming developers certainly consider user experience their highest priority, and many fear video ads will wreak havoc on it. The nightmare scenario suggests that upon seeing video ads, users will delete games because they’re concerned about how much of their precious data those ads are eating up over a 3G or LTE connection.

This dread is shared by many digital pubs – Facebook was beset by user hysterics when it began auto-playing videos on its mobile app and website. But high-definition video ads optimized for a smartphone or tablet screen are quite small – typically 2-4 MB for a 15-second clip. In addition, it is essential that your mobile video ad server be able to compress and optimize the file size while ensuring video quality doesn’t suffer.

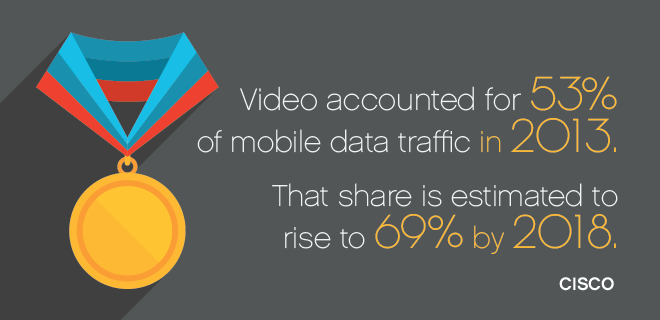

Educating users on this matter is another story – you may need to include language around video ads explaining how little data they take up. However, consumers seem to be growing more comfortable with streaming video via their network connections, especially as more devices offer LTE capability. According to a Cisco report, in 2013 video accounted for 53% of all mobile data traffic. The report goes on predict that by 2018, that share will rise to 69%.

Latency Lately?

Studies have shown that users will abandon digital videos in droves if they take more than two seconds to load. Can you imagine their level of irritation when a mobile video ad loads slow, holding them back from their desired content?

To bypass potential latency issues with dynamic ad insertion, some video publishers have gone old-fashioned on mobile by stitching advertising to their content – in the case of long-form content, they’re effectively building pods. Indeed, some of the first mobile video ad servers set about stitching ads and videos together, which is a very inefficient process for mass amounts of short clips and creatives.

However, providers have optimized ad serving to enable dynamic ad insertion (as well as mobile video RTB). One technique is HTTP Live Streaming (better known as HLS), a protocol developed by Apple for Quicktime and iOS, and supported by most players. HLS splits a video stream into a series of smaller HTTP chunks can be downloaded with little latency. And once again, the video ad sizes are small and can be delivered quickly.

Fighting Fragmentation

There’s great deal of mobile video fragmentation, especially in terms of players and buy sources. Dealing with – or even avoiding – the hazards that arise with fragmentation come down to the ad server you work with.

First, the ad server should be an simple integration with your current systems and support your player. The more players the ad server supports, the better in case you find a more optimal solution. In addition, potential ad-to-player clashes should be smoothed out through encoding technology on the server’s back-end, allowing for seamless ad play.

A publisher is going to want multiple buy sources to ensure supply meets demand and that it has access to a variety of ad types – particularly in regard to length. Managing these sources should be streamlined via a single unified dashboard provided by your server. In addition to wrangling multiple buy sources, it should offer premium features such as real-time analytics and buyer performance metrics, as well as tools like category blocking.

Be careful of the lack of standardization in how networks sell video ads – instead of just charging by video start, some use completion or engagement rate to judge when to pay out. As for qualms about ad quality, most networks are stocked with premium content but still employ curation to keep out inappropriate ads as well as ads that conflict with publisher content standards. In addition, ad servers may have quality assurance controls at your disposal.

Skeptical over the size and performance of the mobile video audience, many premium brands have been slow to develop for the channel, with some simply reusing their TV and desktop video ads. This leads to another issue: optimal ad length. A December Digiday article pointed out the ridiculousness of tying together a 30-second clip (or two) with a 20-second sports highlight reel. It seems shorter ads will perform better on smaller screens, especially if they’re being used in interstitials.

As mentioned before, having a variety of buy sources gives pubs options when it comes to ad length, but many we talked to want to keep users happy by enabling them to skip ads. Considering YouTube’s success with its TrueView skippable ads on mobile over the last two years, this seems like it could become a standard practice. In September, Google Vice President of Display Neal Mohan reported that TrueView ads recorded three times as much engagement as non-TrueView over a month-long period.

Waiting for Demos

Many in the industry would agree that the introduction of panel-based metrics to desktop video set that channel on fire – in terms of sales, that is. Suddenly TV buyers holding the brand budget purse-strings saw buying desktop video in a familiar language rather than a plethora of obtuse metrics.

The lack of panel-based metrics for measuring mobile video is hobbling publisher efforts to scale direct/guaranteed mobile video sales. Unable to offer the demos TV buyers crave, mobile video struggles to break into mammoth linear budgets.

But publishers should be prepared for a rush of mobile ad spend because widespread availability of panel-based mobile metrics is coming soon, likely this year. Nielsen has long been working on the mobile wing of its OCR product – last year reports said ABC was beta-testing Nielsen’s mobile offering, and the company recently signed an expanded agreement with CBS regarding cross-channel audience measurement. Within the news of comScore’s measurement partnership with Google is the promise of enhanced mobile metrics in the near future.

Without such metrics, mobile video is proving a hard direct sell – but there are perks. First off, it’s a great channel for reaching younger, tech-fluent audiences. And targeting capabilities often include age, gender and geo. In addition, broadcasters selling around television content can cite similar audiences to their TV demos (probably skewing younger).

This leads to another concern – the gap between agencies and publishers over how mobile video should be treated as a sales channel. Because users tend to view mobile videos in full-screen format, thereby capturing their full attention, creative would seem to be best executed and measured more like a TV unit. However, publishers suggest that buyers view mobile video ads as extensions of their desktop cousins, seeking metrics like CTR and features like companion ads. The latter are not impossible to deliver, but can be logistically challenging, especially on a smartphone screen; their worth is questionable. In addition, studies have shown increased user engagement when social buttons appeared within mobile video ads.

However, on a larger scale it seems publishers are increasingly coordinating multichannel sales efforts, but they complain that buyer budgets are siloed off rather than connected in a similar manner. They want mobile video to be broken out on an invoice, one publisher told us, because they’re not convinced of its effectiveness as a channel.

The maxim is true for advertisers and publishers alike: you have to be where consumers are – and they’re increasingly stretched across a variety of devices. For publishers, enabling mobile video is an essential step for building true cross-channel ad products, whether or not advertisers are ready for them.

Publishers should be confident that mobile video ads will not produce latency concerns and only have a minimal effect on user experience. Although mobile panel-based metrics to lure in TV budgets are still in development, publishers should be employing this fast-growing revenue channel – arguably the rising champion of mobile revenue – but be well aware of the issues that come along with fragmentation.